The wrought-iron gate pictured above is called FitzRandolph Gate and stands at the main entrance to Princeton University. Its presence here on a TAPH post about the obligation of colleges is not just because I live in Princeton and bike through that area regularly, but because of a significance the gate acquired over 50 years ago. Originally erected in 1905, the structure designed by McKim, Meade and White honors Nathaniel FitzRandolph, the son of a 17th-century Quaker settler of Princeton, who “was instrumental in raising the money and land required to build the college, and in 1753 he gave the original four and a half acres on which Nassau Hall was built.“

Use of the gate was rare as it remained “closed and locked” almost all of the time. Then Princeton’s Class of 1970 “‘in a symbol of the University’s openness to the local and worldwide community,’ ensured upon their graduation that the FitzRandolph Gate would always remain open to the town and the world beyond it. Their class motto, “Together for Community,” is inscribed in the east pillar of the gateway, as is a peace symbol in the zero of 1970.”

A gate signifies entry; it’s sometimes used as a metaphor for a test. In the first installment of this two-parter about the debt colleges owe to students and to the rest of us, I reviewed the opinions of several commentators who think that all of the flutter about President Biden’s ‘cancellation’ of certain portions of student debt are in many cases misinformed — we really don’t know what’s going to happen in terms of inflation and it probably will not be as much as the greatest naysayers predict — and/or misguided — the overwhelming majority of those receiving this relief are NOT well-off; they make under $75,000 a year and those with Pell grants tend to come from groups that have been marginalized by the overall structure of American society. But my more vigorous argument was that while the debt relief is welcome we would be foolish to stop with that action. If we do so, we will find ourselves in the same situation all over again. As I wrote a few days ago, ‘There should be much more done to assure college students get value for the dollars spent in paying tuition to their institutions.’ We have to find a way to require colleges to solve the problem of the expenses and debt that students bear when pursuing an education.

In that first post, readers also found links to an ‘article and accompanying data (that) examined “how well federally-funded higher education institutions are equipping students to earn more than a high school graduate.”

Colleges get LOTS of federal aid besides what they receive in tuition. The expectation is that they provide a public good. Public. Again, colleges have to help their students not only find a way into education but to find a way out to the rest of their life that does not encumber them with debt that crumples their existence.

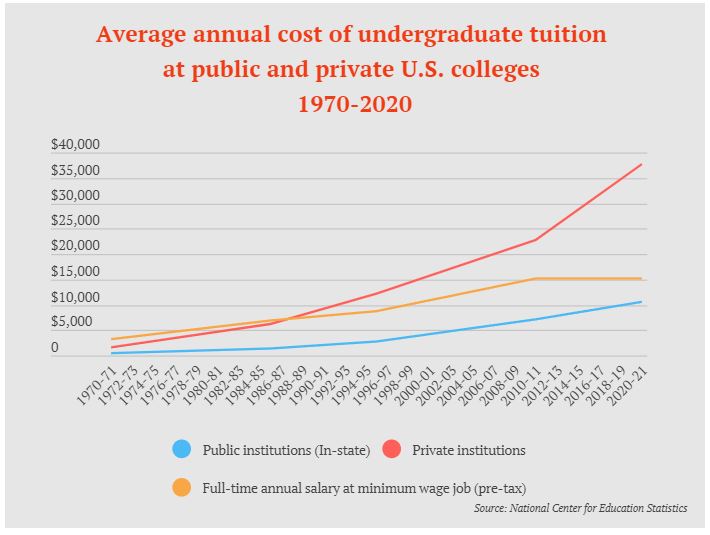

And that’s where the FitzRandolph Gate comes in. Those 1970 graduates of Princeton University by insisting that the gate always be open committed themselves and their institution at least symbolically to greater openness, to more outreach from colleges to serve the public. In some ways, that worked. The following September, the first women were admitted to Princeton University as students much to the outrage of Princetonians like Samuel Alito. Members of marginalized communities also had much greater success in gaining admission to this and other top-tier institutions. However, getting into college is only part of the issue: getting out in such a way that you can succeed matters just as much. As to that latter consideration, in the 50 years since that time the average expense of college in-state tuition and fees for one year at a public non-profit increased 2,580%.

Not a typo: 2580%

This report states that “During the same period, tuition and fees at private institutions jumped by a similarly astronomical 2,107%, from $1,706 in 1970, to $37,650 in 2020. Between 1970 and 2020, the dollar had an average inflation rate of 3.87% annually, resulting in a cumulative price increase of about 567% during the last 50 years.“

This astonishing increase occurred without a corresponding leap in value for a college diploma although owning that piece of paper is still preferable to not having one. And it also occurred without any sense from the colleges that they were driving their customers err… students into awful debt. Colleges need to work differently now. Opening the gate is not enough; making sure the people can get out of that gate without burdens that cripple their lives represents the problem that debt cancellation did not solve. And we must get colleges to solve the problem because outside intervention is not going to work.

What claims do we want colleges to make to solve this problem?

No one that I have read knows exactly what to do about the failure of colleges to curb their costs or to validate their contribution. Would Senator Rick Scott’s College Act help?

I don’t know because Scott would “require the Secretary of Education to publish a variety of important and common-sense metrics” to hold colleges accountable. Metrics? Sounds like the basis for a claim and the platform for a test. What claims would such a test allow? What claims do we make of ourselves as college graduates might be an interesting place to start such an exploration. One good thing about my personal history of testing is that it qualifies me to say that doing this would be really really complicated. That goes right to the edge of my expertise, but take my word for it: the claims of a the value of a college education in aggregate are obviously more complicated than the claims each of us can make about the value of our own college degree. And aren’t those considerations more tangled than World’s Largest Ball of Twine in Cawker, Kansas?

But what should colleges do to evaluate better the investment of tuition?

First, they need to deal with their rising costs. Does Baumol’s disease come ionto play or is the problem more the revenue theory of costs—the idea that colleges and universities bump up spending to match Unlimited student loans that they attract? That question is too much to bite off for this post. There are LOTS of opinions on that topic . Instead, let’s look at how colleges might evaluate themselves in order to determine how to become more effective. (Yes, the phrase ‘becoming more effective’ constitutes ‘fighting words’ for many academics. But not suffocating students with lifelong debt matters more to me right now.)

While I was at ETS, this issue of what undergraduate education should provide launched numerous initiatives and manifold essays. If we as a nation are any closer to deciding that question, the news has not reached my precincts. Almost ten years ago, Anthony Grafton in the New York Review of Books stated that “No generalization (about how to evaluate colleges) could do justice to this vast and varied scene … private and public, mass and elite, ancient and ivy-covered, contemporary and cutting-edge.” And yet the succeeding decade brought both more of a desire to attain such a general evaluation and less of any consensus on what that might resemble. If anything, the emotions around colleges and what it is they should be doing grew hotter and boiled over into the realms of critical race theory, #metoo ramifications, and free-speech debates. Those well-meaning college administrators who state that the answer is to both prepare for professional life and prepare for lifelong learning risk attaining terminal fatuousness: “because thou art lukewarm, and neither cold, not hot, I will vomit thee out of my mouth.” Like the author of the Book of Revelation, I do not believe in pulling any punches

Zena Hitz in her book Lost in Thought desires that a college degree equate to a claim of ability to engage in the intellectual life, to read critically, expound rationally, listen curiously, reflect acutely, and wonder widely. Many a corporate executive and not a few parents would complain that this was the wrong claim to be made. Instead, they would argue the relevant assertion to be made about a college graduate is whether that young person can succeed in a particular profession, move out of their family home, pay for their own phone, and eventually provide grandchildren. Okay, the last one isn’t really fair, but it’s real.

The arguments in this realm tend to be pendular; college curricula swings between courses on coding, project management, data science and seminars on Realism and Romance in the East German Cinema or Metaphysics: the Paradoxes of Time Travel. Determining which colleges offer the best bet for a return on what we need to be a lower set of expenses for students requires deciding what claim we would like to make. Senator Scott obviously doesn’t tip his hand as to what methods and processes by which the government would make any claim or stipulate accountability.

I will post a poll to see what others think the construct of college effectiveness should contain but no matter the results we must require colleges to answer this question in a way that does not let them off the hook. Otherwise that gate may as well have barbed wore around it for many people because the problem of cost and debt will not disappear.