The Internet is atwitter and abuzz and in some cases aghast at the decision by President Biden to cancel student loan debt. My brother Gene Bouie squarely raised the unsaid elements of at least some of that resistance in writing to a swath of engaging people this morning about the cancelling of student debt by President Biden and I was lucky enough to be included in the crowd. Here is what Gene noted considering the Presidential action:

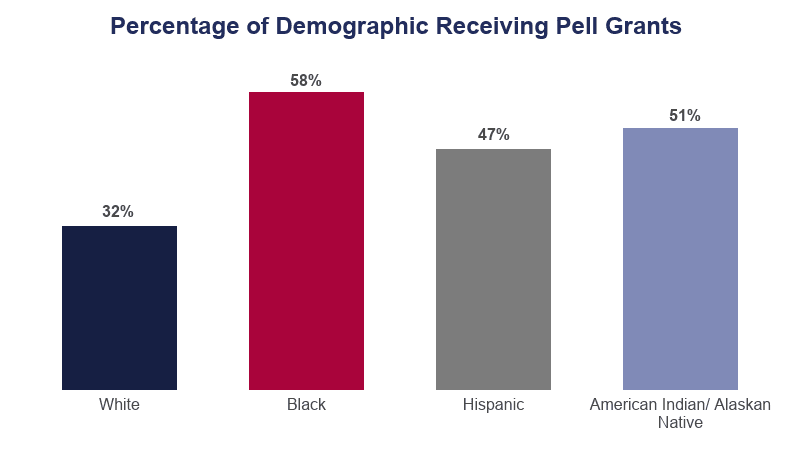

“51% of Pell Grant funds go to students whose families earn less than $20,000 annually – the largest majority. 38% of Pell Grant recipients came from families whose annual income falls between $20,001 and $50,000. Only 5% of Pell Grant recipients come from families that earn over $60,000 or more annually.”

Gene then inserted this chart:

And then he wrote, “We see who benefits; now we understand the pushback.”

I happen to agree with Gene and in that email exchange supplied another statistic that for me points to the wisdom of this student loan discounting: “The Department of Education estimates that almost 90% of the relief in the measure will go to those earning less than $75,000 a year, and about 43 million borrowers will benefit from the plan.”

Looking at the reactions on the Internet it’s fun to see what amounts to much less vitriolic sparring than we have had on other topics. Here are two examples: one from Nathan Tarkus and another from Oliver Willis; the latter is very quick to criticize Democrats for being insufficiently aggressive in their messaging about what they have accomplished.

I am not an economist and completely unqualified to discuss the inflation question raised by some critics. Some of those number crunchers think the canceling of student debt for this particular cohort will have a mild effect on inflation, some think it will have a severe effect, and some argue it will have no effect but that the further postponement of paying back student loans will spark further inflation. The variety of opinions offered confidently and even imperiously reminds me of reading comments by Mets fans on what the team should do next; they are plentiful and ultimately unverifiable as predictions.

Where offering an opinion from the perspective of Testing: A Personal History makes some sense is discussing what happens next. As welcome as this action is to me there should be much more done to assure college students get value for the dollars spent in paying tuition to their institutions.

In other words, I think we should make colleges pass a much stiffer test regarding their eligibility to be recipients of this money. Of course come up objections spring forth immediately; e.g., don’t toy with the individual rights of students to choose their place of higher learning, colleges already have to be accredited, you can’t measure the value of education. The last one is pretty interesting because we do measure the value of education and it happens every year whether it’s U.S. News and World Report or Princeton Review or Wall Street Journal with its international ratings. A measurement of which I became aware recently thanks to reading Freddie deBoer looked at higher education’s broken bridge to the middle class.

The article and accompanying data examined “how well federally-funded higher education institutions are equipping students to earn more than a high school graduate.” it’s only one measure of a very complicated construct entitled higher education, but it is a measure that matters to many people. If you ask the kids starting Community College or State Colleges this fall why they are going there as I did a few times in the last week they will tell you it’s to get a better paying job. The answer might be different at the top 1% of schools, but for most incoming students their goal (besides having a good time) is ending up with a sheepskin that converts into more money.

The author of this study, Michael Itkowitz, advocated that “…it’s essential that policymakers put more effective guardrails in place that assure students will be financially better off after they attend a federally funded institution, ensuring taxpayers get a return on their massive annual investment in higher education institutions across the United States.”

See? Now we are back to that student loan cancellation announced yesterday, because that moolah is another tranche of investment made by all of us. Itkowitz continued, suggesting that if lawmakers did not act to erect those guardrails,“… millions of students may end up worse off than if they hadn’t enrolled in the first place, and low-performing schools will continue to cash in taxpayer subsidies while failing on the promise to prepare students for success in the 21st century economy.”

So what do we do? So far, effectively, we have done a whole lot of nothing about those guardrails. And the rankings that do exist contain such obvious biases that they would not help us in determining whether we should continue to invest in institutions. To return to Gene Bouie’s initial point regarding inequality in the higher education system, It is worth listening to Malcolm Gladwell’s points about organizations such as U S News and World Report unfairly categorize HBCU institutions . Banks have to pass stress tests. Restaurants endure the minute examinations of health inspectors as some of us saw on the series the bear. When I worked at American Airlines, the FAA was much feared in regards to the safety guarantees we were required to make. Shouldn’t colleges have to make a better claim about where and how and to what effect the monies they receive from students and from the federal government play out? What do you think? Write me and I’ll include your ideas in the next post in Testing: A Personal History.

This is great, TJ. There’s an opportunity here for some entrepreneur to get into the college testing business, in this case actually testing colleges!

Yes, I’m sure that this business idea is hatching somewhere. I was a little bit uncomfortable to read that Senator Rick Scott of Florida has a proposed law to evaluate colleges in mind. That raises the critical question of what is the construct that would be tested. I wouldn’t want it to be a political one

I too am wholly unqualified to speak to this topic but wanted to share Jim Dickinson’s recent excellent article in WONKHE: Tighter finances will impact students. Should we warn them? to add to the debate from a UK perspective. You will see that the situation is similar here. I am especially horrified by the graph halfway down Jim’s article, which shows the anticipated negative impact on our poorest students.

Two other WONKHE articles that give a sense of where we’re at in terms of value of HE/construct:

Post qualification admissions distracts from the real fair access issues

Finally some guidance on external examiners

Sorry, those links have not worked! Here they are in full:

https://wonkhe.com/blogs/tighter-finances-will-impact-students-should-we-warn-them/

https://wonkhe.com/blogs/post-qualification-admissions-distracts-from-the-real-fair-access-issues/

https://wonkhe.com/wonk-corner/finally-some-guidance-on-external-examiners/

Pingback: Colleges Need To Pass A Test Too – Testing: A Personal History